Are you claiming as much for depreciation as you could be? Don’t miss out!

Depreciation is a fundamental aspect of a business, as it has the ability to affect its bottom line, tax bill and value; therefore, it is important to understand how it works. Tradies Tax can help you with understanding the concept surrounding depreciation.

Depreciation – What Is It and What Can Be Depreciated?

When a business asset gradually loses its value over time, this is known as depreciation.

For example – if you purchase a ute, a vehicle is considered a depreciating asset, as throughout its productive life, it’s worth declines from its original purchase price.

When it comes to tax time, the majority of business expenses are deemed tax-deductible; however, a business’s fixed assets are what is depreciable.

A fixed asset is something that helps a business generate income for more than 1 year – such as vehicles, machinery, tools, and technology.

If an asset doesn’t lose its value, then it cannot be depreciated.

Intangible assets like copyrights and patents may also be depreciated, as their value declines upon expiry dates.

Consumables such as stationary can be claimed on tax, but have to be claimed within their year of purchase; therefore, not making them depreciable.

What is the Purpose of Depreciation?

The purpose of depreciation is to help you determine the true cost of doing business, reduce your tax bill, and estimate your business’s value.

Below, we explain those 3 primary functions in more depth to help give you a deeper understanding.

1 – Depreciation as an expense/cost of doing business

In order to understand your business’s profitability, you must understand all of its costs – including depreciation, as it relates to business assets that will devalue and need replacing. This highlights the importance of knowing how much value your business assets will lose throughout the year, and needs to be noted on your Profit and Loss Statement.

2 – Depreciation and Tax

Since depreciation amounts need to be deducted from your business revenue, it can subsequently decrease your tax bill. However, there are rules surrounding claiming depreciated assets from a tax perspective.

Not factoring in depreciation, can cause you to pay too much tax.

3 – Business Value

When business assets decline in value, so can your business; they go hand in hand. A trades business using older machinery and equipment may not be worth as much as a business using newer machinery and equipment.

As an asset declines in value, so does their security, and it is important to keep in mind that this may make it harder to secure loans and finance.

How to Calculate Depreciation

There are multiple ways you can calculate depreciation. Below are 3 of the most common methods:

- Straight Line Depreciation

This is the most commonly used method, and involves distributing the depreciation expense evenly over a fixed assets lifespan.

- Diminishing Value Depreciation

This method implies that depreciation deductions of an asset are higher in the first year/s of ownership, with the base value declining after each year as a result of the assets decline in value.

- Units of Production Depreciation

Alternatively, this method doesn’t only depreciate an asset based on time, but also factors in the units it produced.

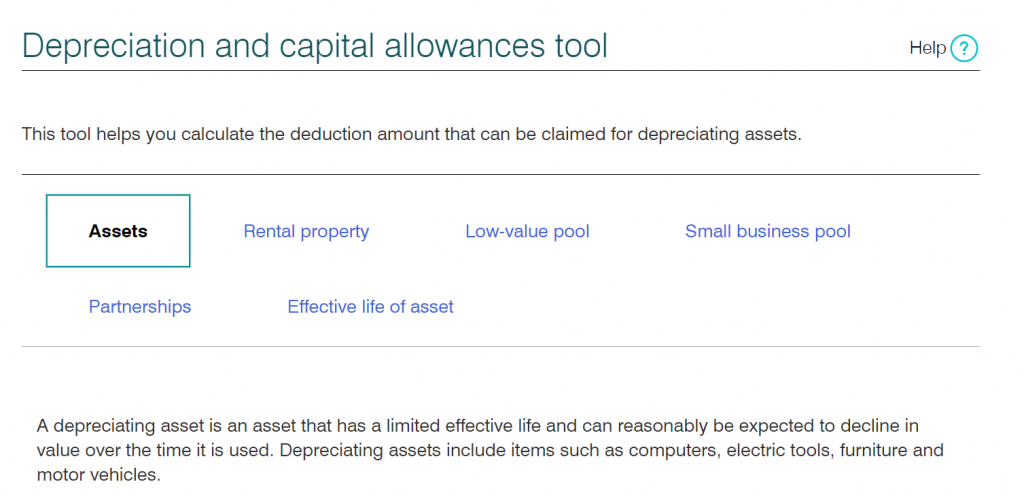

Moreover, if you are ever stuck wondering about a depreciable assets lifespan, the ATO have a Depreciation and Capital Allowances tool you can utilize, to help work this out.

You can access this tool with or without a MyGov account.

How Can Tradies Tax Help

Depreciation can be seen as complex and confusing, but understanding it will prove beneficial when it comes to being aware of your business’s value and costs.

If you need assistance with creating a depreciation schedule, or setting it up in your accounting software, contact Tradies Tax today!

We can view your Profit and Loss Statement and business assets, and help you work out their value and the true cost of doing business – to help maximize its profitability.