As the EOFY approaches, if you hold a QBCC license, it is important to ensure you conform with QBCC regulatory compliance and financial reporting requirements.

The Queensland Building and Construction Commission (QBCC) upholds regulatory compliance and financial reporting requirements that assist in ensuring an operating trade business has appropriate working capital and asset backing.

As a result of this, on June 30 2021, all building and construction businesses that hold a QBCC licence must ensure that they meet their Minimum Financial Reporting requirements relating to their Current Ratio and Net Tangible Assets (NTA) to ensure that they will be able to successfully lodge their Minimum Financial Report by 31 December 2021.

When preparing for this report, it is important to make sure the business has a positive Current Asset Ratio, which means that your current assets are higher than your current liabilities (1:1).

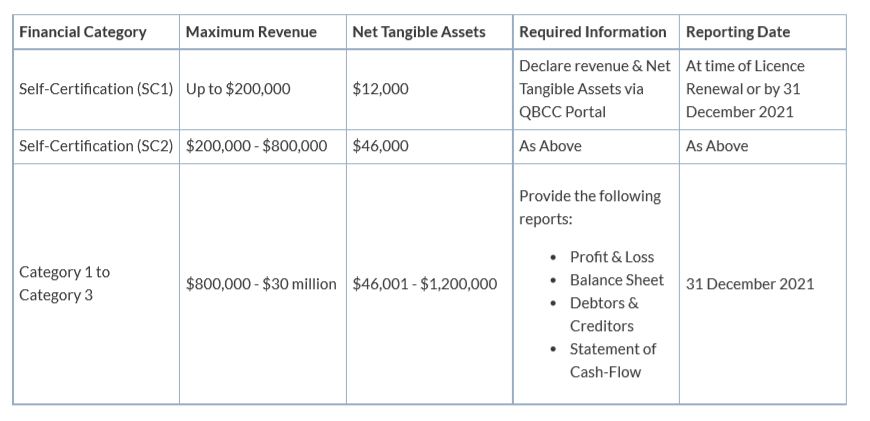

Furthermore, a positive Net Tangible Asset should be at least $0 for a QBCC licence holder (see the table below for your NTA requirement).

To help obtain a positive business position, licensees could do things such as raise invoices for services completed before June 30, calculate their stock & materials on hand, calculate their work in progress, and aim to lessen their liabilities to help meet their Current Ratio and Net Tangible Asset requirements.

The QBCC posted the table below, as a way of reminding licensees of their reporting requirements:

(QBCC, 2021)

What Happens Now?

As June 30 is fast approaching, it is important to start preparing to meet your Minimum Financial Reporting requirements now.

Keep in mind your tax planning strategies to help provide you with guidance and understanding into your businesses financial health regarding QBCC licensing and tax this reporting season.

To gain a comprehensive understanding of your businesses financial positioning and health; particularly as we approach EOFY, contact Tradies Tax today to see if you are compliant.

We have accountants that are extremely knowledgeable in QBCC and have helped a lot of clients over the years with QBCC entity’s, who can assist with any of your reporting needs in a very specific and specialized way.

These EOFY QBCC requirements are highly important, and must be met.

For more insight into how Tradies Tax specialize in QBCC, click here to watch our Associate Director Gene Herder discuss what we can do to help licensees.

For further insight into the QBCC reporting process and requirements, click here to visit the QBCC website.